Question: What is the right age to start teaching kids about money?

Answer: If they are breathing, they should be learning about money!

OK, that may seem a little over zealous, but here’s the thing…

Just like our need for oxygen from the moment we pop out into the planet, most of us don’t survive very well without ample amounts of financial resources to provide for the things we need. We really do NEED money in our lives to survive well and you can’t convince me otherwise.

Even if you’re a monk, somewhere there is money exchanging hands to handle your needs.

The fact is, you can work for (trade your time and energy for), beg, borrow or steel, the things that you need to live: water, food, clothing, shelter, education, transportation, etc. Even if YOU are not working for these things, it took money for SOMEONE to pay for what you are begging, borrowing or stealing!

Where is MONEY on the NEEDS vs WANTS scale anyway?

Seriously. In any classic “needs vs wants” lesson, I’ve never seen MONEY on either side. This strikes me as absurd because without MONEY, it’s hard to have anything on either list.

Legislatures Debate Over What Age to Teach Financial Education To Kids

All over America, governing bodies of well-meaning adults are trying to decide when financial education should be taught in school. The answer is quite simply…

IN EVERY GRADE and at EVERY AGE!

We have been teaching kids and teens about money since 2002 and many of those kids and teens have taken Money Camp and Camp Millionaire several times.

What we know based on watching and listening to the participants who have attended more than once is that the ones who have guidance and coaching at home tend to remember some of the information. The ones who don’t have ongoing guidance and coaching, don’t.

Why? Because as one of our wonderful coaches said, Repetition is the mother of skill. No practice, no lessons. No lessons, no skill. No skill, well . . . we know what happens when there’s no skill. You have a society like ours that’s deep in debt with no knowledge of how it got there or how to get out.

It is only through the actual practice of USING money on a regular basis that a child truly will learn to use this resource wisely. That’s why the right type of allowance is so important.

What to teach and When to teach it

First and foremost, you must know that children learn the most by the examples that are set for them in their closest environment. That means whoever is caring for them needs to really watch their financial Ps & Qs if they want their little charges to grow into financially savvy adults.

Once you have the ‘set the best example’ thing down, you can move onto teaching them more specific things at different ages.

I don’t generally buy (no pun intended) the guidelines I’ve read by others on when children are ready for certain financial lessons. I think you just need to throw information at them all the time and it will stick when it’s meant to stick.

Capture Those The Teachable Moments

I’m big on letting circumstances dictate what should be taught at the moment. And by teaching, I do NOT mean preaching. I mean sharing personal lessons, asking the child questions about their experience, listening to what they say, exploring information together as a team. No one likes to be lectured to and lecturing a child about money is the worst thing you can do in regard to preparing them to be financially savvy adults.

In my Ultimate Allowance book I talk at length about teachable moments and give you plenty of actual money conversations you can have with your children based on actual events that may occur.

Here’s some ideas of what and when to teach kids about money

Remembering that every child will be different in terms of what information they are ready for, here goes…

In Kindergarten…teach them about coins and paper money. Let them start learning to equate cleaning up the room with a number of coins (let a local bank sponsor this lesson). Teach them how to accumulate coins and money at home and make it FUN to watch the amount of money grow. It doesn’t matter if they can count it yet; they just need to get excited about having more of it.

In 1st – 5th Grades...continue teaching them about coins and paper money and begin equating the money with what the money will buy AND the amount of time and energy they have to trade to get that money. Start talking about what you do with money when you get it, i.e., how to manage it (we teach The Money Jars system). First and foremost, teach them, Pay Yourself First!

Start talking about how they can MAKE money themselves; literally ‘make’ the money, rather than ‘earning’ it. This is the way you begin to plant the first seeds of entrepreneurship.

Most importantly, make sure your children have at least TWO bank accounts, not just one (see the money jars system for more information). It’s critical that kids have money they are accumulating to invest (the savings account) and money they accumulate to spend. And that money should never be in the same account. This is most adults biggest problem!

In 6th – 8th Grades…continue the entrepreneurship conversation and start adding in how you start businesses, run businesses, looking at the money part of business. If you don’t know how to teach this stuff, check online for a variety of great entrepreneurship programs. Bizworld and Kidscashcoach both have simple business programs you might like.

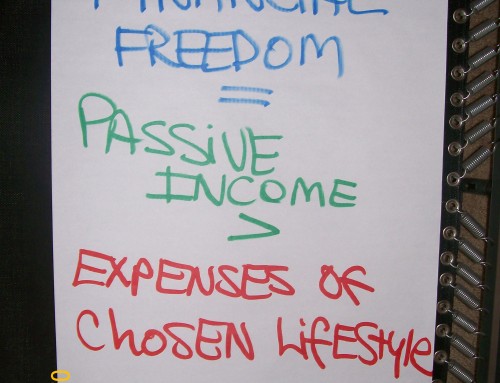

This is also the perfect time to start introducing your children to assets and passive income. The Money Game® is a great choice for a family or group of students. It teaches the kids the power of investing in assets and they quickly develop the understanding that it takes assets that produce passive income to make them financially secure and eventually financially free.

In 9th – 12th Grades…time to introduce budgets, balance sheets, business plans and the idea that they are the CEOs of their own lives. Keep having conversations about how they can MAKE money for themselves rather than EARNING it by working for someone else. Though a huge percentage of adults never take the leap to owning their own business, if they know it’s a viable option, it’s easier to make that leap later if they want to.

Start talking about different kinds of assets: real estate, stock market, businesses. You don’t have to be an expert. Find experts in your community and invite them to talk to your kids or students. They love sharing what they know with kids. (Make sure you interview them first to see how they’d be with kids:-)

SIDE NOTE: We had a panel of parents and grandparents attend the last hour of our recent Moving Out! for Teens camp here in Santa Barbara. We asked them to share with the teens their biggest regret. Know what it was? That they had waited so long to start their own businesses and work for themselves!

In 11th – 12th Grades…now is the time to start teaching them how to move out and stay out. They are so interested in types of bank accounts, renting apartments, buying cars, credit cards, insurance, getting jobs, resumes…anything that has to do with stuff they’re about to have to do is fair game and readily consumed.

Our recent Moving Out! for Teens camp showed us how hungry 16-18 year olds are for this information. They have no idea why they’re learning what they are learning in school but when handed LIFE-STUFF in camp, they gobbled it up and wanted much more. Feed it to them!

The Right Age To Teach Kids About Money

Hopefully you see that every age is the right age to teach kids about money. Don’t wait. Don’t not teach them because you don’t want them to have to worry about it. They’ll have to WORRY about it if you don’t teach them!

Share the topic of money at every turn. It’s part of life. It’s ubiquitous for most of us and just like air to breath and water to drink and food to eat, if we want an abundance of money in our lives to experience the best that life has to offer that money can buy, we have to know how to use it wisely. And that takes repetition and exposure to the topic of money all throughout childhood and beyond.

Now go out there, set a good example and see how many money savvy adults you can create.

Leave A Comment