Dear Financial Educator,

Are you looking for a unique, highly effective, activity-based, information-rich, imagination-igniting financial education program for your students (ages 10 and up…and I mean UP)? Great…you’re in the right place.

Imagine for a moment that the world of money was simply a game and to win the game, all you had to do was learn, and use, the rules to that game.

Guess what? If you learn the simple, time-tested financial tools and habits that help people become financially free, you and your students can win The Money Game and be financially free, too.

With The Money Game® you can teach kids and adults about money and investing in a way that is relevant, effective and as much fun to teach as it is to play!

Help Us Improve the Financial Literacy of YOUR Students or Children

My name is Elisabeth Donati and I’ve been putting on money camps for kids and teens called Camp Millionaire since 2002. I developed this program after realizing in my 30’s that the only reason I didn’t understand money was because no one taught me about money!

I realized that for a financial education game to be effective and for kids to really understand and remember the information, the program had to be:

- Activity-based

- Interactive

- Experiencial

- Lots of fun

- Relevant

- Enjoyable for teachers or group leaders to use with their students

The Money Game® was developed with all those criteria in mind.

We all know there’s a HUGE financial literacy problem in America and Internationally.

The signs are everywhere…

Adults are in debt up to their eyeballs.

- Governments are laying off employees, cutting hours and raising taxes because most of the adults who run them don’t understand money and finances either.

- Our federal government makes it all but impossible to teach kids the life-skills they need to be successful because all of the unnecessary testing requirements.

- Parents think schools should teach kids about money; schools think it’s the parent’s responsibility. This means it’s rarely taught in school OR at home.

- Though several states have made financial literacy mandatory, rarely are there funds to teach it and what IS taught is often boring and inadequate.

- Many teachers are uncomfortable teaching a subject they don’t understand and aren’t actively practicing.

- Most of the programs used in schools are dull and boring and rarely cover the financial lessons we most need…like investing!

- Our youth are programmed to think in terms of jobs but JOBS don’t usually set people free…teaching kids entrepreneurship and showing them how to be the CEOs of their own lives is what creates financially free adults.

My Passion And Purpose: Build the Most Powerful Financial Education Program Ever

I had three painful realizations in my mid-30’s.

- I realized that I didn’t know enough about managing and investing my money.

- I realized I was going to have to teach myself.

- I realized I was not alone…everyone I talked to seemed to be in the same boat.

Once I become aware of how little we are taught about money, I started noticing that people everywhere were talking about money…in the store, at the gas station, at parties, IN A BATHROOM STALL on the cell phone.

I was shocked. People were lost in the game of money with no roadmap of what to do or how to win the game.

About this time, a retired business attorney named Walt, wrote a letter to the editor of our local newspaper asking this simple question: “When, as a nation, are we going to start teaching our children about money?”

I stopped dead in my tracks. Something struck me deeply and I knew I had to do something about the lack of financial education around the world. I said out loud, “Why doesn’t someone create a money camp for kids where they learn what none of us are taught in school?”

“Just wanted to say we had HEAPS of FUN playing The Money Game!” Anita from New Zealand

Financial Games Are The Best Way To Learn About Mone

When I first started exploring the world of financial education, I ordered all of the financial literacy curriculums I could get my hands on. They were boring and irrelevant. But most of all, the existing financial literacy curriculums didn’t teach the information I wished I HAD LEARNED when I was young!

Things like…

Learning the basic financial principles financially free people know and use…like Pay Yourself First, Put Money to Work For You and 28 others!

Learning the basic financial principles financially free people know and use…like Pay Yourself First, Put Money to Work For You and 28 others!- Learning that money is simply a tool to help us reach our dreams, and help other people reach theirs.

- How to do things like shake hands properly, introduce yourself and keep agreements.

- The mental and physical steps to setting, and reaching, short-term and long-term goals.

- How to THINK about money, abundance and wealth in ways that support your goals.

- The real value of wasting money on what we call Piddlyjunk.

- The importance of creating passive income streams so you can work because you want to, not because you have to.

- Why giving back and doing good with some of your money is critical to having enough of it in the first place. (It has to do with an abundance mentality.)

I also wanted to…

Invite kids to think differently about money and wealth so they can create the amazing lives they dream sooner rather than later.

Invite kids to think differently about money and wealth so they can create the amazing lives they dream sooner rather than later.- Teach kids to question common financial decisions, not just do things because others are doing them or someone said they should.

- Teach kids to say, “I wonder what business I can start to make my own money?”

- Think about how to make the world a better place while making money at the same time.

- Have kids realize that financial freedom is their responsibility and no one else’s.

- Teach kids that their lives are a result of all the choices they make.

I took all this information and rolled it into The Money Game!

The Money Game is Relevant Because Of WHAT We Teach

It is Effective At Getting The Information To Stick

Because Of HOW We Teach.

The Money Game® use a very active style of teaching called accelerated learning. In simple terms, we teach visually, auditorily and kinesthetically.

Participants do more than listen to the lessons…they act out the lessons.

Participants do more than listen to the lessons…they act out the lessons.

- They role-play, have contests, play games that teach financial lessons.

- We use stories and music to enhance the lessons.

- Participants receive moolah for participating.

- We have a lot of fun learning the most important lessons in life.

- Participants experience how money works in real life.

- They repeat important phrases over and over again which makes retention easy. (They rarely take notes!)

- The program is action-packed from start to finish.

Here’s the most common thing students say after they attend our program…

“It Was So Much Fun!”

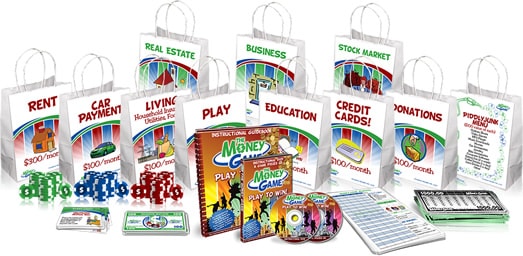

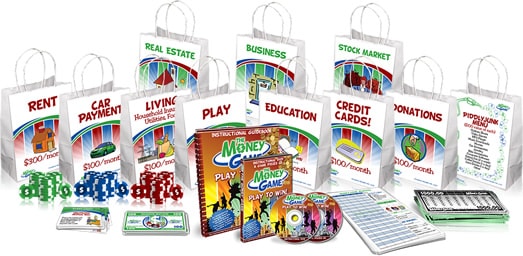

So what exactly IS The Money Game? The Money Game is a money simulation game where players (ages 10 and up) earn, make, and manage money like they will as an adult. Using The Money Game Expense Bags, players learn critical financial habits like Paying Themselves First.

MONEY HABIT #1:

Participants learn to Pay Themselves First BEFORE paying their expenses!

The best part about the way we teach our programs is that we CELEBRATE everything! Just imagine how school might have been different for you had your teachers celebrated when you did something well!

The Key Was Creating A Financial Education Game

Where The Kids Were The Pieces

In the beginning, people kept telling me to build a board game but there were already great financial board games out there…Monopoly, Cash Flow for Kids, Money and a few more. The challenge with board games is that you can’t play them with a large group of kids or adults.

Instead, I kept thinking…What if I created a game where the KIDS ARE THE PIECES?

Instead, I kept thinking…What if I created a game where the KIDS ARE THE PIECES?

That’s when The Money Game started to evolve.

We created bags where the participants paid their expenses using their $1000 paychecks. They invest in assets with the money they save by Paying Themselves First.

Their favorite part is when they start receiving Passive Income for every asset they invest in. At this point, the students are hooked!

In The Money Game, the students are the pieces. They move around the room (aka…the board) using their income as they would in real life. The lessons are so real that THEY CAN’T NOT GET IT.

A Profoundly Life-Altering Experience For Adults Also.

In One Of Those Slap Your Forehead”Ah-Ha” Sort Of Ways!

The Money Game is a PROFOUND experience for adults. Here’s why…

When you teach a child about money for the first time, you’re installing a new program on an empty hard-drive, so to speak. Kids say, “Oh, I see. Cool.”

Adults, however, learn the basic financial information they didn’t learn as kids, and realize they missed and quite often have very emotional reactions to this information…

Adults, however, learn the basic financial information they didn’t learn as kids, and realize they missed and quite often have very emotional reactions to this information…

“If only I had known this years ago!”

“Why didn’t anyone teach me this stuff?”

“I can’t believe I never learned the power of Pay Yourself First!”

“Why didn’t anyone explain WHY I should start saving and investing?”

Even though the numbers in the game are conceptual…heck, rent is only $300…the lessons are life-altering for adults who never learned about money and investing for their futures.

Sound Financial Principles Lead To Financial Freedom

The simple financial principles and habits that The Money Game® teaches are the same time-tested financial principles and habits that most wealthy people use to get wealthy and stay wealthy, and that most of us didn’t learn when we were young. Financial principles like…

Money Game’s Financial Education Objectives

(i.e., What The Players Learn)

There are many subtle lessons woven into The Money Game. Here are the objectives built into the basic game…

1. Financial Freedom is Your Choice Choice is a powerful tool and the first step in any achievement. We want kids to know that they must choose to grow up financially free before they will be motivated to take action to create this for themselves. In order to reach a goal, any goal, the goal must first be chosen.

2. Creating Financial Freedom Is A Matter Of Developing The Right Habits Habits are actions we do without having to think about what or why we’re doing them. Financial habits are established early on in life whether we want them or not. We acquire them through listening, watching, and experiencing how money works from our parents, other relatives, friends and the media. READ MORE

3. Pay Yourself First By far, the most important habit of all financially free, wealthy, rich people is that they pay themselves first. Paying yourself first means putting your money into a place where it can work for you. It is not, however, always an easy habit to establish. Many people have the propensity to pay the bills first, buy the things that they want, or do things for others BEFORE putting their money away.

4. It’s Better To Tell Your Money Where To Go Than Ask Where It Went Most people get a paycheck, put it in the bank (or have it direct-deposited) and just start paying bills and spending money. They think to themselves, “Well, I’ll save some money if there’s any left over.” We call this the Left-over Investment Strategy – which rarely works. This strategy often leaves people with a lot more “month” left over at the end of their money.

5. Assets Feed You, Liabilities Eat You One of the biggest lessons most adults learn the hard way is that they spend way too much of their precious financial resources on what we call “Piddyjunk” in The Money Game. In addition, one of the biggest distinctions we make in The Money Game, as compared to other financial education programs, is that we consider the home you live in a liability. It’s usually the Bank’s asset, not yours! (Yes, it’s an investment, but it isn’t an asset by our definition, which is: assets put money IN your pocket and liabilities take money OUT of your pocket on a regular basis.)

6. Don’t Put All Your Financial Eggs Into One Basket All too often, adults put all of their investment/retirement money in one place (and a variety of mutual funds don’t count). It’s critical that kids learn the different asset classes (Three Pillars) and the importance of investing in at least two and preferably all three. This is also referred to as diversification.

7. Save Early, Save Often It is often touted that compound interest is the most important concept kids can learn. These days, it’s rare that individuals get wealthy from compound interest. Unless you’re a financial institution, credit card company, private lender of some sort, or invest in second mortgages, your wealth is no longer coming from compound interest. Albert Einstein is praised for this comment, “The most powerful force in the universe is compound interest” but it’s actually compound growth that kids need to understand.

8. It’s Not How Much Money You Make That’s Important; It’s How Much You Keep Adults have a tendency to think that having more money will solve all of their financial problems. In truth, it’s generally not more money that solves their problems but learning to better manage and invest the money they already have. Once that happens, yes, it’s great to learn how to increase the amount of money that is coming in.

9. Money Is A Tool To Reach Your Dreams More than any other substance on the planet, money makes people crazy. By and large, people have used money as a measure of self-worth, success, authority, and wellbeing ~ to mention just a few.

10. Make Money Grow By Putting It To Work For You Of all the investment principles, putting your money to work for you is both the most illusive and most challenging aspect of becoming financially free. It’s the investing piece that is so often left out because financial education instructors continue to be focused on what to do with the paycheck they assume all their students will eventually have. (One of the reasons this is prevalent is that the instructors themselves only know how to earn money by having a job.)

Click here for a detailed description of The Money Game Principles.

Why Teachers And Parents Are Raving About The Money Game

- It’s experiential…even kids ‘labeled’ with learning disabilities learn from this highly active financial game.

- It can be used as a traditional school programs, home school curriculum, day camps, after school programs, church youth groups events, youth leadership events, nonprofit youth organizations, homeless shelters with families, foster care youth.

- It changes your expectations of a great financial literacy education program forever.

- It includes 9 simple accelerated teaching techniques that improve the way your students learn.

- The Money game is effective and easy to tailor for age groups from 9 years old to adult.

- The Money Game can be modified to fit any length program; from 3 hours to several days.

- It can be presented in numerous formats (1 hour a day for many weeks, once a week for any number of weeks, every day for an hour for a week, etc.).

- It can be used as a stand-alone financial education program or used under an existing education umbrella.

- It teaches the financial principles wealthy families teach their children when they want to make sure they know how to be good stewards of their inheritances.

- It explains how to quickly and effectively teach a room of students (young and old) basic money principles they must know to be financially successful.

- It can be used in an employer-sponsored financial education program for employees.

- Participants don’t take notes. They learn with their whole bodies and the lessons last forever.

- Easy to alter for any culture or age group.

- Easy to expand by adding additional financial lessons activities you may already have and enjoy teaching.

Testimonials To The Money Game’s Powerful Ability

To Teach People Of All Ages About Money And Investing

Here’s what teachers, our trainers, parents and our attendees have said about playing The Money Game…

Teachers Love The Money Game and The Accelerated Learning Techniques:

“The Money Game made teaching financial literacy easy!”

“The Money Game made teaching financial literacy easy!”

“Have you ever seen excitement on a child’s face when they are grasping a concept or showing such confidence that they are willing to take endless risks in their learning? Well, I am a fifth grade teacher and have been using The Money Game and my new Accelerated Learning skills for three months in my classroom and see this reaction daily from my students. The energy in my room has gone through the roof! The students have told me that they just remember more than before. Accelerated learning has changed my practice forever! Thanks.” Jodi Lemieux, Creative Wealth Coach, 5th grade teacher in CT

“My students are having so much fun learning about money!”

“My students are having so much fun learning about money!”

“I’ve been using The Money Game in my high school classrooms and the kids have such a great time. The things they learn from playing The Money Game are the things I wish I had learned as a young girl. It’s so frustrating to see the rest of our high school students NOT getting this critical information when it’s so easy to play this game with them. I wish I could teach them all!” Lola Paredes, Creative Wealth Coach and High School Teachers, Santa Barbara, CA

“My students are having so much fun learning about money!”

“The accelerated learning process taught with The Money Game is phenomenal. The entire experience was built on a standard of excellence. I am impressed with the quality of everything. I am extremely well-read in the topics of business, life, psychology, philosophy, and economics and I learned many things I had not previously known from the Train-the-Trainer workshop.” Ken Parsell, Creative Wealth Coach, Teacher in PA

“This was an eye opening experience!”

“Not only did I learn a simple approach to money and creating wealth but I learned many new techniques to use in the classroom. I had a great time and met many interesting people.” Patricia Katz, Creative Wealth Coach, Teacher

Our Creative Wealth Coaches Love The Money Game:

“I couldn’t teach our adults the importance of saving and investing without The Money Game.”

“I couldn’t teach our adults the importance of saving and investing without The Money Game.”

“I’ve been using The Money Game with adults for over four years and I never cease to be amazed at how quickly and easily it gets essential financial lessons across to adults who simply never learned about money.” Celia Hahoe, Creative Wealth Coach, Virginia Tech Facility

“Who knew a GAME could teach people about money!”

“When I attended Creative Wealth Train-the-Trainer I had no idea that a financial education game could teach so many powerful financial lessons and habits…especially to many of the adults at the training! The Money Game is by far the only way I would ever approach teaching kids and adults the basic financial principles and habits they must know to get their personal finances in order. I use most of these principles in my own life and was delighted to see how thorough the program and game are when it comes to the subject of money.” David Henseler

“Children learn the most profound financial lessons with The Money Game”

“One of my most compelling moments was when one girl read the principle, ‘Being broke is temporary, being poor is a state of mind.’. The kids grew still and the expressions on their faces were amazing. I could see them realize that there was hope for a change of conditions. We repeated it together and talked about it a bit. Awesome moment. What I loved most was their ability to make connections to the lessons and the principles. The Money Game was so powerful with the realization that ‘assets feed you.'” Suzanne Landers Zavatsky, Creative Wealth Coach

“The Money Game is a fun and interactive way to help participants understand that earning an income and paying expenses are only part of the story. As they play The Money Game, they learn the whole story…including WHAT to do with their money to make it work for them.” Stacey Sherman, Creative Wealth Coach

“The Money Game is a fun and interactive way to help participants understand that earning an income and paying expenses are only part of the story. As they play The Money Game, they learn the whole story…including WHAT to do with their money to make it work for them.” Stacey Sherman, Creative Wealth Coach

Parents love knowing their children will eventually be able to move out and stay out!

“The Money Game is fun! I can see in playing this game over and over again, instills the learning of how to best manage their money. What a great game, teaching a glossed over concept.” Tony LaFrance, parent of participant

Best Of All, Our Participants (young and old) Love The Money Game:

“I took Camp Millionaire three times because I enjoyed playing The Money Game. I took it first when I was just 9 years old then again when I was 13 and the last time I was 15. I even went back last summer and helped out during camp. I’m now 17 and heading off to M.I.T. in a few weeks and I just want to say that without Elisabeth’s program and The Money Game, I wouldn’t feel nearly as ready to handle my own finances. Thank you Elisabeth!” Andrew Adams

“I took Camp Millionaire three times because I enjoyed playing The Money Game. I took it first when I was just 9 years old then again when I was 13 and the last time I was 15. I even went back last summer and helped out during camp. I’m now 17 and heading off to M.I.T. in a few weeks and I just want to say that without Elisabeth’s program and The Money Game, I wouldn’t feel nearly as ready to handle my own finances. Thank you Elisabeth!” Andrew Adams

“The best part of Camp Millionaire is playing The Money Game.” Too many kids and teens to mention!

“A light after a dark tunnel” …. I learned so much from The Money Game and enjoyed it immensely through a very lively, colorful, emotional, supportive environment. I am looking forward to attending another program like this. Thank you a lot.” Terry Inglese, adult participant

“A light after a dark tunnel” …. I learned so much from The Money Game and enjoyed it immensely through a very lively, colorful, emotional, supportive environment. I am looking forward to attending another program like this. Thank you a lot.” Terry Inglese, adult participantSo Here’s What You Get When You

Invest In The Money Game For YOUR Students.

The Money Game is available as a complete downloadable kit where you print and assemble the pieces yourself OR a ready-to-play package…whichever is more convenient for you. Both kits include…

- A simple, straight-forward, step-by-step Instructional Manual. We’ve included every step you need in this easy-to-read manual…including the actual dialogue you use to teach the game.

- Immediate access to our online Instruction Videos. Follow along with your manual and you’ll be teaching The Money Game in no time.

- All of the pieces to the game. Print and create at home, school or the office or ready to use right from the box. If you purchase the Ready-to-Play version you have access to the download version immediately.

- If you order the downloadable version, you’ll get a list of easy-to-assemble materials you’ll need to complete your game: poker chips, plastic containers as storage and gift bags. A trip to your nearest party or dollar store and you’re good to go.

- Extra optional goodies we’ve added to make it more fun…including our famous Camp Millionaire Moola and the 10 Money Game Principle as 11 x 17 PDFs you can print and laminate for your walls.

Here’s the BEST part! In addition to purchasing the best financial literacy game on the planet…you’re joining a team of individuals and organizations committed to empowering kids and adults everywhere with the financial education information they need to live well.

With your purchase of The Money Game, you get…

- Immediate access to The Money Game Website where you will find the materials, training videos and tons of information on teaching financial education.

- Phone and email access for advice, questions and suggestions about the game.

- ALL of the bonuses listed below!

Valuable Bonuses

50 Money Making Ideas for Kids & Teens Ebook

50 Money Making Ideas for Kids & Teens Ebook

Your child will be delighted with these 50 easy and fun ways to make their own money and stop using you like their very own personal ATM/bank machine! ;o) Enjoy! Value: $39.99.

Allowance Secrets: To Give or Not to Give? Ebook

Allowance Secrets: To Give or Not to Give? Ebook

In this FREE eBook, you will finally figure out what works best for your family as you meet TOP 25 “Kids and Money” Experts, Family Coaches, and Highly Successful Entrepreneurs who share their personal opinion and tips on Whether Or Not To Give Your Child An Allowance. Includes chapter from Elisabeth, creator of The Money Game! Value: $39.99

The 3 Keys to Raising Money Savvy Adults Report

There are three things you must know, and do, in order to turn those wonderful kids and students of yours into adults who know what to do with money. This must-read report explains those things!

Value: $19

‘How money savvy is my child?’ Quiz Software

‘How money savvy is my child?’ Quiz Software

This Fun FREE Quiz will help you figure out just how money savvy your child is! Value $19.99

Raising Business Smart Kids Ebook

Raising Business Smart Kids Ebook

Teaching kids about money empowers them for success at home, in school and in business. “Raising Business Smart Kids” gives you lots of activities you can do with your child, from the cradle to college, to teach them about money and give them skills for financial success. Value $27.00

If you’re truly serious about teaching your kids, teens or adults how money works in a way that works…and you’ve been looking around for something unique and new and…dare I say…revolutionary…then look no more.

Order The Money Game Today…Start changing lives tomorrow!

- The Money Game is available as a fully downloadable product where you save by creating and assembling your own game pieces (all PDFs and training videos are available immediately).

Call 786-627-8520 if you have a Purchase Order, have questions or want to place your order over the phone.

![]()

Wishing you and your students the very best life has to offer!

Elisabeth

P.S. MY GUARANTEE: If you don’t find The Money Game (Ready-to-Play Version only) to be the most entertaining and effective financial education teaching resource on the face of the planet, I’ll refund your money up to three months after your original purchase (minus shipping) if you return the game in usable shape . If you’ve read the Instructional Manual and watched the Instructional Videos and played this game with your students (ages 10 and up), and you don’t notice that they are learning to Pay Themselves First, Invest in Assets and love Passive Income, send me an email and tell me what you’ve done with the program. If I can’t help you make it profoundly effective for your audience, I’ll refund 100% of the purchase price (minus shipping) within the three month period.

P.P.S. I promise you will wish you’d learned this stuff when YOU were young.

P.P.S. I promise you will wish you’d learned this stuff when YOU were young.